How to Apply Tax Exempt to an Order

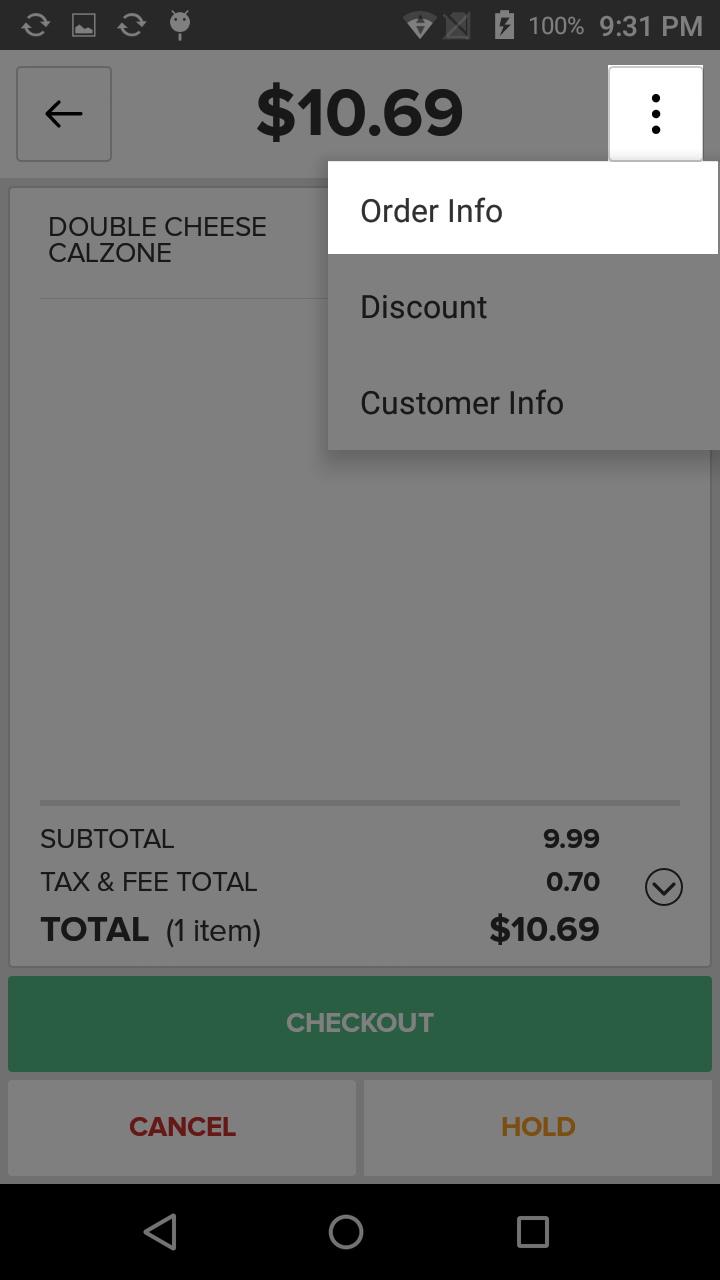

To apply Tax Exempt to an order using the Heartland Point of Sale, begin by pressing the Sales button on the Home Screen. Next choose the Items you wish to apply Tax Exempt to and add them to the order. Once the Items are added, press the overflow button at the top of the screen, then select the Order Info option from the listings to navigate to the Order Information screen.

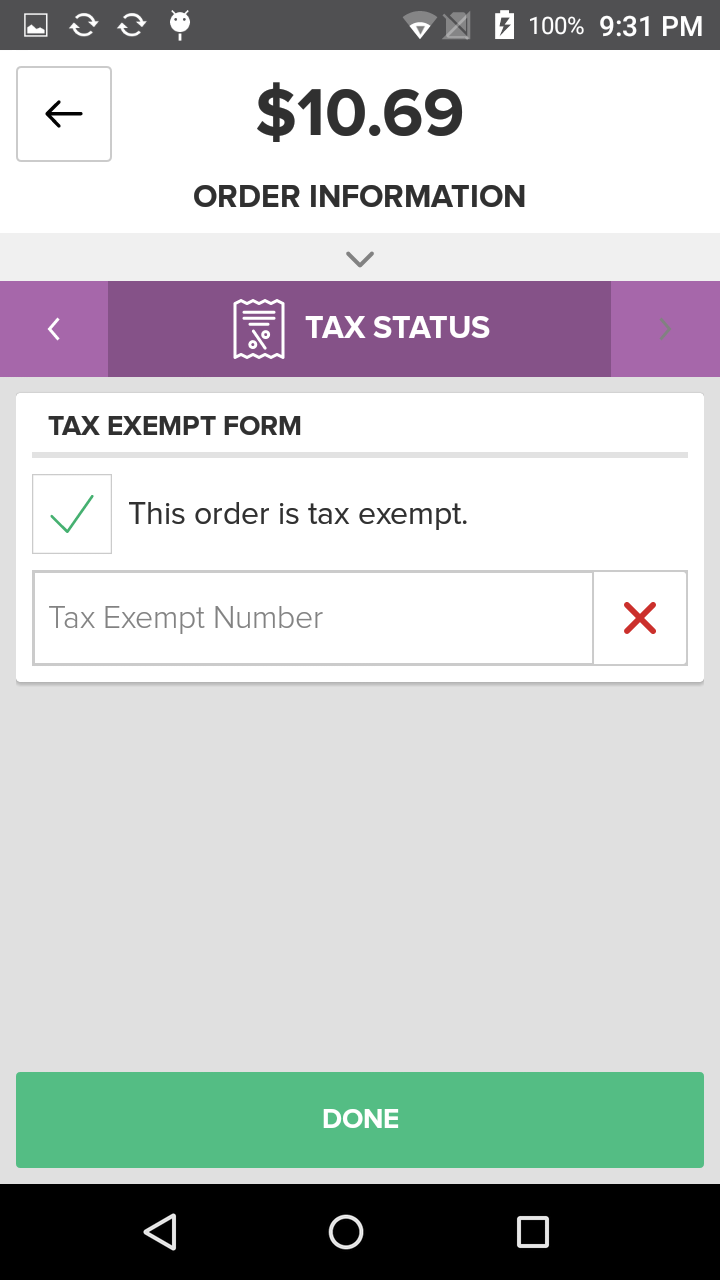

In the Navigation Ribbon at the top of the screen, locate the Tax Status tab. On the Tax Exempt Form, enter the Tax Exempt number in the provided field and ensue that the "This order is tax exempt." checkbox has been selected. Press the Done button at the bottom of the screen when finished to add the Tax Exempt.

Step by Step Summary

- Press the Sales button on the Home Screen

- Add Items to the order

- Press the overflow button

- then select the Order Info option

- Navigate to the Tax Status tab

- Enter the Tax Exempt Number

- Ensure the "This order is tax exempt" checkbox is selected

- Press the Done button